In the same way that tax laws start off simple and get much more complicated over time, the process of figuring out what a plaintiff in a personal injury case actually receives after a verdict keeps getting ever more complicated.

In the same way that tax laws start off simple and get much more complicated over time, the process of figuring out what a plaintiff in a personal injury case actually receives after a verdict keeps getting ever more complicated.

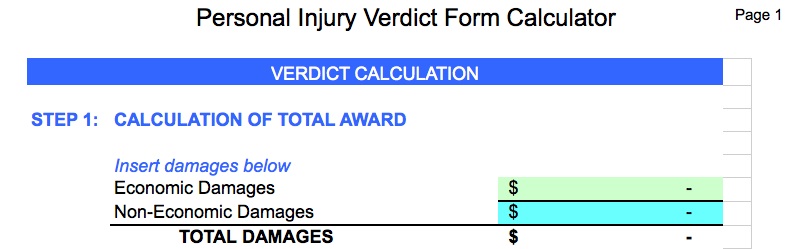

Fear not—this article provides a downloadable Excel sheet that calculates all the values for you by simply putting in the total award amounts, percentages of fault and lien amounts. This is a worksheet I developed with Bob Arns, and we used it in trial often. We also used it in the early stages of a case to estimate net values for settlement. Since it made our lives easier, I’m sharing it here so other attorneys can make use of it, too.

First, a bit of background: In the days before Li v. Yellow Cab Co. (1975) 13 Cal.3d 804, the plaintiff received the entire award issued by the jury from any defendant that he chose to go after for the money, unless he was partially responsible for the injury himself, in which case he received nothing. The rule was simple, but kind of harsh to both sides. For example, defendants with 1% fault could pay 100% of the award, and a plaintiff with only 1% responsibility for the injury would receive zero. As with tax law, loophole upon loophole (and at least one ballot initiative) made the processes a great deal more complicated.

The form Bob and I developed is neither “plaintiff” nor “defendant” oriented. What follows is a quick explanation of how these calculations were derived, with the “steps” corresponding to the steps on the worksheet. If you disagree with the calculations or have any other feedback, please leave a comment below.

Click here to download Net Verdict Calculator.

STEPS 1-3 LAW

Li v. Yellow Cab Co. (1975) 13 Cal.3d 804 got rid of the harsh comparative fault rules that prevented recovery with 1% of fault on the plaintiff. Proposition 51, which was codified as Civil Code § 1431.2(a), did the other half of this work, by limiting joint and several liability only to economic damages (i.e. plaintiff could only ask any defendant for all his economic damages regardless of level of fault of the defendant, and non-economic damages were only awarded according to fault of that defendant). Since percentages of fault determine the amount each defendant owes, the jury must make a finding on these issues and break down the award between economic and non-economic damages and percent of fault for each party.

STEP 4 LAW

Under Torres v. Xomox Corp. (1996) 49 Cal.App.4th 1, and Civil Code Section 1431.2, the plaintiff’s comparative fault is subtracted from the economic award off the top. Therefore, you must determine the percentage of economic to non-economic and subtract plaintiff’s fault from the economic component only. The non-economic are handled later.

STEP 5 LAW

It seems like dealing with a pretrial settlement would be easy. If the jury awards total damages of $300,000 against all defendants, and one of the defendants already settled for $50,000, you would just subtract $50,000 from the $300,000, correct? Wrong. Under Espinoza v. Machonga (1992) 9 Cal.App.4th 268, the court found that just like a verdict, a settlement has both an economic and non-economic component that are handled differently. Therefore, the economic part of any pretrial settlement is subtracted from the economic award to plaintiff after the comparative fault deduction.

STEP 6 LAW

Just like a pretrial settlement, if a plaintiff receives money from workers’ compensation, some amount of that has to be deducted from the award since they already received that money. Torres, supra also held this is not as simple as it would seem. Under this “Espinoza” approach, workers’ compensation benefits are to be allocated between economic and non-economic damages “in the same proportions as those damages are awarded by the trier of fact.” (See also Scalice v. Performance Cleaning Systems (1996) 50 Cal.App.4th 221.) Remember that there is a set-off from the award no matter whether the employer is actually entitled to recovery in money on their lien, which will be determined in a later step. Therefore, the economic part of any workers’ compensation lien is subtracted from the economic award.

STEPS 7-8 LAW

Under Civil Code § 1431.2(a), the defendants only pay their share of the non-economic damages. Therefore, the various percentages of fault for the non-economic damages are calculated, and Step 8 totals the award.

STEP 9 LAW

This is the confusing one. When a workers’ compensation lien exists, one not only calculates set-off (see Step 5) but also the amount of repayment that the workers’ compensation carrier gets back, if any. The formula to determine the “threshold level” is set forth in Associated Construction & Engineering Co. v. Workers’ Comp. Appeals Bd. (1978) 22 Cal.3d 829, 843. In short, the employer gets nothing back until after the “threshold” number of their personal fault multiplied by the total damages is reached. This prevents a negligent employer from recovering for their own negligence.

STEPS 10-13 LAW

These sections add or subtract from the verdict for awards of costs, medical liens and other deductions.

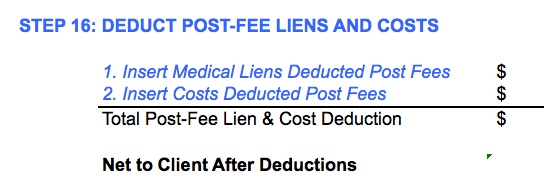

STEPS 14-16 LAW

These sections calculate a net recovery after attorneys’ fees and case costs and medical liens, if applicable.

I hope this summary and the accompanying Excel sheet will help you figure out the trial value of a case with all the additions and subtractions that go into the current state of the law for calculating such recoveries. Special thanks to Bob Arns of The Arns Law Firm for collaborating with me on this post.

Disclaimer: Cogent Legal and The Arns Law Firm assume no liability for the use of this worksheet. The law may change after preparation of this worksheet and individual cases may require the application of different law.